You have probably attended many courses teaching you how to pick up your winning stocks. But more often than not, traders overestimate their ability to predict the market and end up badly in the stock market. This is dangerous, as our overconfidence may lead us to unnecessary risks. Therefore, this course teaches about the theory, techniques, and rules on profit.

Foundation of Systematic Trading TradersGPS program is developed by a team of professional traders and validated by thousands of traders for more than ten years. By completing the course, you are expected to master selecting stocks, timing the entry and exit, determining allocation and risk management, and preserving and growing wealth over the long run.

To optimize you learning experience, prior exposure to trading and financial market knowledge will give you the edge to follow through this program.

Foundation of Stock Trading

10 Lessons | 52 minutes

Reading Stock Charts and Patterns

5 Lessons | 20 minutes

Essential of Technical Analysis

8 Lessons | 3 hours 30 minutes

Price Action Analysis

9 Lessons | 55 minutes

Systematic Turtle Trading Strategy

1 Lessons | 1 hour 10 minutes

Learn Proprietary Trading Strategy TradersGPS

4 Lessons | 3 hours 40 minutes

Many traders believe that ability to read and analyse price changes are very important to determine where likely the price will move next days, months or years. They plot these prices and price changes on a chart and apply various indicators to identify patterns that keep reoccur in the stock market. There are various ways to represent market data on charts, and a trader should know how to read them.

Learn how to use average prices to identify trends, and how to identify short or long-term trends to suit your trading horizon.

Learn how to identify trends that weigh and react more toward current price data.

Learn how to use a signal line to systematically identify an optimum point, or price, or time for early entry and exit.

Learn how to measure the strength of a trend that helps traders to be exposed to lower risk and higher return trades.

Learn how to pick the right candidates that can potentially offer you with a huge return.

Learn how to identify stocks that are potentially overbought or oversold, or they are simply forming into a new bullish or bearish trend.

Learn how to gauge market sentiments to control your risk-adjusted return.

Learn how to measure the sentiment of your stock by detecting the unusual price behaviour.

There are many challenges to master in technical or chart analysis. Price, volume, and time are the three most basic components that many traders often look at.

Your price action technique, you probably need to understand how market manipulations might affect prices. Volume Price Analysis will help you to identify unnaturally moves in the market and reveal the DNA of the stock market. This course will prepare you to be a confident and emotionless trader.

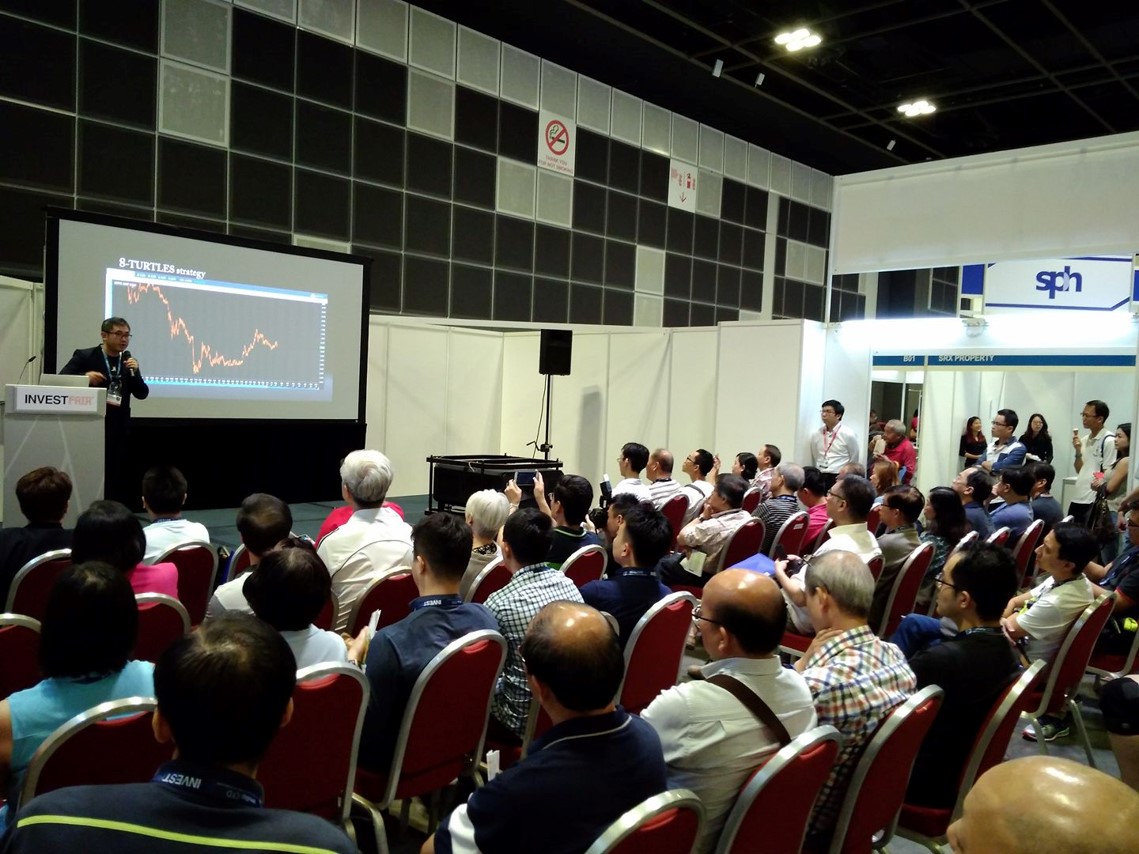

Learn how legendary traders, Richard dennis and Willian Eckhardt’s proprietary trading method, that had successfully generated $200Million in 10years $1600, back in 1970

TradersGPS is a well-known systematic trend-following strategy. It first developed traction after it once helped a Singapore remisier from a near to bankrupt experience and cleared a massive debt within a short span of 16 months. TradersGPS is a stock market survival methodology featured in the book ‘How I Turn A $250,000 Debt Into Profits Through Stock Trading, The Systematic Trader’.

Together with AlgoMerchant team, this profitable formula was transformed into a robust trading system that allows traders to succeed in the stock market with little to no market knowledge. TradersGPS system can identify short- and long-term trading opportunities, gain the upper hand in stock picking, and profit from trends. By leveraging technology, traders can systematically execute this profitable strategy with a simple guide for what and when to trade.

The trend-following strategy is also suitable for traders who want to build portfolios with relatively smaller capital. All you need to do is take the TradersGPS system, kick off your trading journey, and prove that you can be a successful trader.

This strategy allows traders to succeed in the stock market, with little to no market knowledge. The system will show you what and when to trade. All you need to do is kick off your trading journey and prove that you can be a successful trader.

It has a market screener to help traders to identify trading opportunities

It displays arrow-signals to help traders with the entry and exit points

Peak and Trough lines as a secondary conditional exit of a position

Positional and swing trading algorithms for both short and long term profit

Based on a strategy that identify trading signals with have high reward to risk ratio. The strategy aims to ride on early trend formation and relative strength to trail the momentum In the mid term. Targeting above 15% CAGR over the long run. The strategy has been proven to work across various market cycles.

Enhance your portfolio return by tapping more opportunities from the market noises. Targeting overvalued and undervalued stocks undergoing a very short-term trend reversal. The strategy helps portfolios achieving a non-correlated market return.

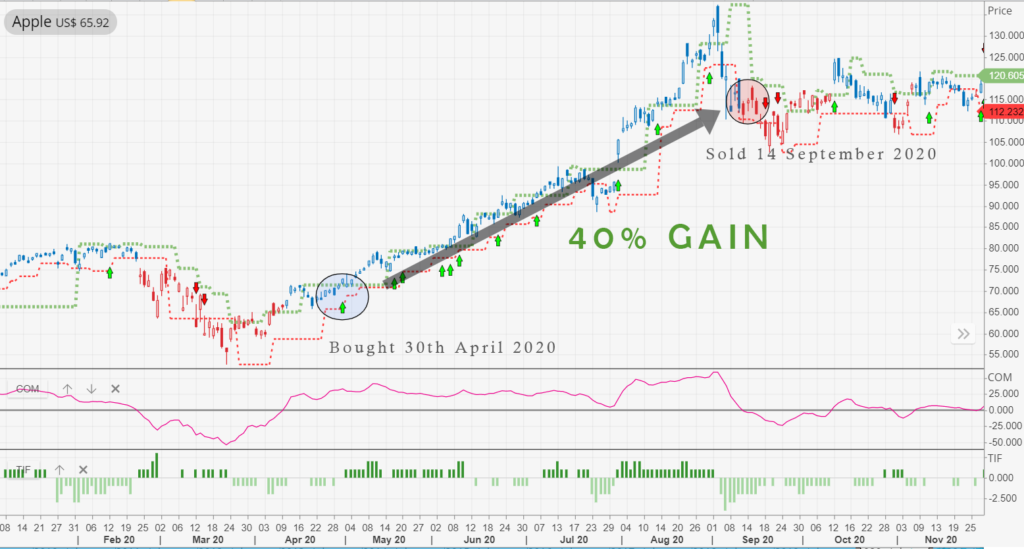

Apple: BUY Apr 30, 2020, SELL Sep 14 2020, 40% GAIN

Nio: BUY Apr 29, 2020, SELL Dec 16 2020, 1533% GAIN

Singtel: SHORT May 27, 2020, COVER Nov 10, 2020, 15% GAIN

KeppelCorp: SHORT Jul 17, 2020, COVER Oct 01, 2020, 25% GAIN

You can keep your loved courses lifetime, and watch them as and when you need them

We provide the complete all-you-need to know guide to master stock trading with TradersGPS system

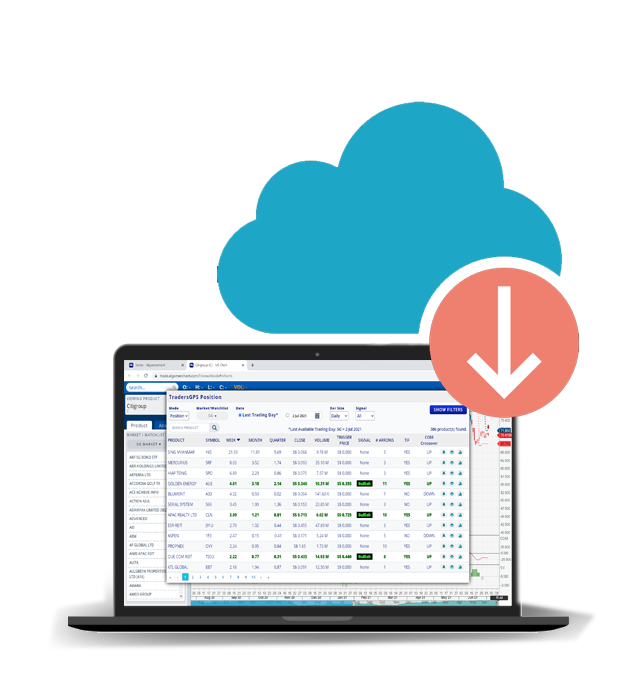

Never again miss out any trade opportunities. Get access to TraderGPS system from our cloud service with an internet connection.

Get a 6 months of full access to our cloud based TradersGPS system

Get together to learn new tips and technique about stock market

Read and analyse historical price data from our professional charting tools. Use hundreds of technical tools from the library

Get yourself updated with the latest news and event from the market.

Learn the experience on how to analyse and execute trades. Our trainers perform a LIVE trading experience to demonstrate managing profitable and losing trades.

Meet your peer traders to talk about market

‘In the past I have been trading by price action. So this is giving me an alternative to look into systematic trading method…’

‘at that time I challenged the trainer to select the stock…, within one week it creates 40% of return… and it is enough for me to cover the initial investment(courses fee)’

‘After attending this course I have a very different perspective….he has simple rules which work in any market condition. And once you follow this rule strictly, it helps us to achieve our financial goal’

‘I have been looking around for the best way to help me buy low and sell high to profit from the market. But not until I met Rein, who told me that the market is unpredictable. And he demonstrated to me simple rules to identify profitable trades. In my opinion, this is the easiest way to generate wealth and income for myself’

Rein Chua is a co-founder and Head of Training at AlgoMerchant, with over 15 years of experience in cross-asset trading, portfolio management and entrepreneurship. He has been featured by several major media like Business Times, Yahoo News, TechInAsia, etc., and invited as a panel speaker by various financial related institutions such as Singapore Stock Exchange, Indonesia Stock Exchange, Share Investors, etc., to give various insights on the how Artificial Intelligence and finance will shape the investment landscape.

Today Rein is managing prop trading fund and actively teaching retail investors and professional on systematic and quantitative trading approach. And he loves to share professional knowledge and experience on how to consistently profit from the stock market.

The information, tools and material presented in this Site are provided to you for informational purposes only and are not to be used or considered as an offer or invitation to sell or issue or any solicitation of any offer or invitation to buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The Site’s contents may not be reproduced in whole or in part or otherwise made available without the prior written consent of AlgoMerchant. Information presented in this Site have been obtained, derived or analyzed from sources believed by AlgoMerchant to be reliable, but AlgoMerchant makes no representation, warranty or guarantee as to their accuracy or completeness. To the extent permitted by applicable law, AlgoMerchant accepts no liability for any loss arising from the use of the material presented in this Site or software provisioned by this Site. No market data or other information is warranted or guaranteed by AlgoMerchant as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such market data and information are subject to change without notice. All of the information, including but not limited to our ‘Performance Simulation’ feature, will always strive to be unbiased in its reporting. AlgoMerchant, or its affiliates, may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Those communications reflect the assumptions, views, and analytical methods of the persons that prepared them.

With AlgoMerchant your account is secure. For your peace of mind, we use advanced firewalls and Secure Socket Layering (SSL) technology, automatic sign-out, and failed login limits to keep your personal information secure.