The Power to Combine Technical, Fundamental, and Macro beyond Human

If the winning patterns are humanly intuitive, we can easily find successful traders. This leads to another question. Are Technical Analysis and Fundamental Analysis effective? Jim Simons, the biggest moneymaker on Wall Street, said that exploitable patterns are the ones humans can’t understand. It requires a large dataset, huge computational power, and multidimensional analysis to decipher.

To predict the direction of a stock like Amazon, investors need to learn the company’s earnings, interest direction, economic activities, etc. Due to the complexity of the Market today, the key to modeling the Market is by using Artificial Intelligence.

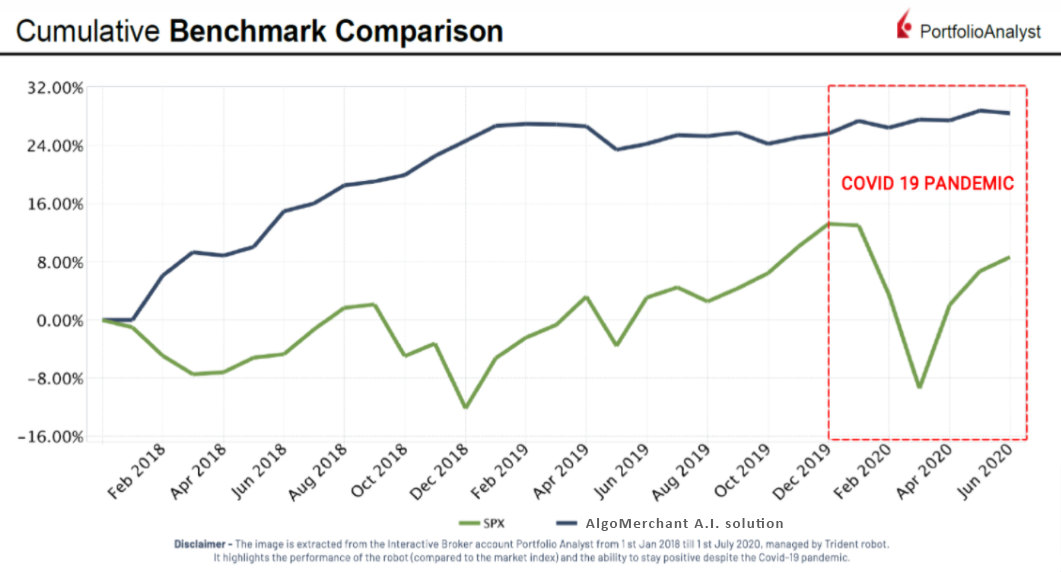

Can A.I analyze the current market affair? We show you the equity curve, portfolio holdings at the time, and LIVE demonstration to understand how A.I solution responds during the Covid sell-off.

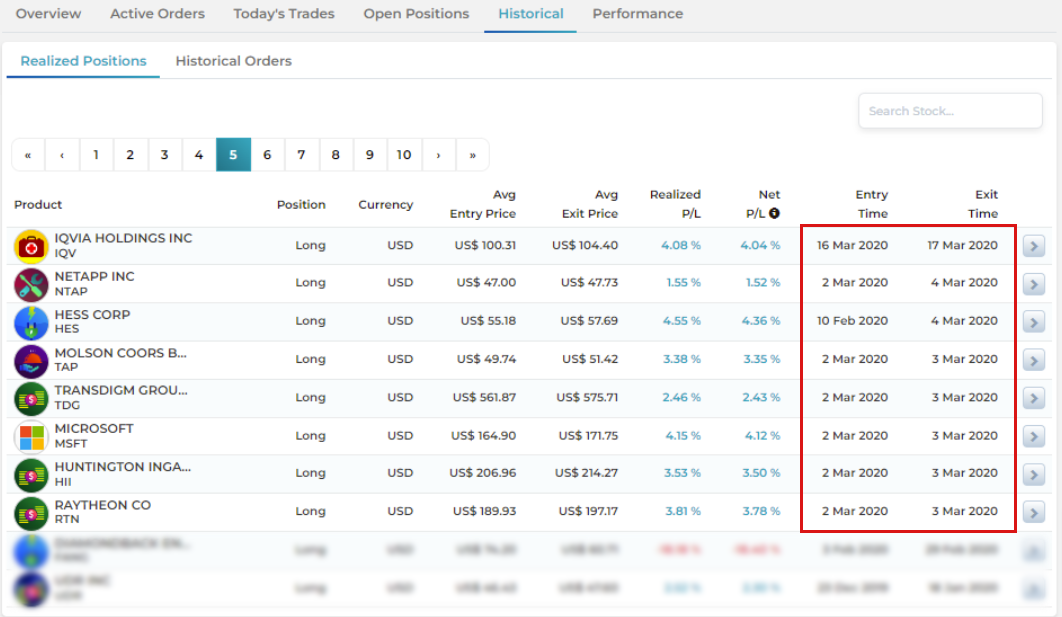

The Intelligence has learned the past, analyzed the market, and calculated execution. In the extreme COVID-19 market sell-off that caused the S&P 500 to plunge by more than 30%, our A.I. solution could generate positive returns of more than 3% during the market plunge.

The portfolio hold by the A.I and it was traded LIVE. Despite big market correction, A.I can identify those performing stocks.

The video was posted 3rd Mar 2020 during Covid 19 pandemic. The A.I helped the trainer,Rein Chua, with the stock selection and made 6 trade executions LIVE.

The video was posted 5th Mar 2020 just before intense sell-off in the market. The trainer sold-off and profited from the 6 selected stocks. It demonstrates the A.I ability to read the market sentiment.

Today, Artificial Intelligence is a buzzword. A lot of people might have a different understanding of the solution. In this course, you explain the concept of Roboinvesting solution and how it differs from other robotic solutions.

The level of interaction is what makes Artificial Intelligence intelligent. Unlike many other solutions in which the programmer or the human hardcodes their solution, A.I. should interact and analyze the Market independently without human biases or interference.

Many people fail in the stock market, not because they are not talented or gifted to perform in a stock market. But their perceptions about risk are very subjective and inconsistent. That is why it is important to recognize the difference between A.I. Vs. human logic in making decisions.

Traders and Investors love to have many screens to capture countless information. But the real challenge is making sense of these relationships, knowing that there is close to an infinite set of data that might affect those relationships.

Due to the complexity of identifying patterns, we use proprietary machine learning and data technology to learn the Market. And be the first to learn our proprietary robot factory, a process to develop an A.I. solution, from creating factors to validating strategy behavior.

In creating a portfolio, to maintain consistency in the performance and manage the risk, the A.I. solution does not focus on optimizing each of the individual trades but a collective performance instead. The methodology emphasizes on statistical approach rather than hitting a single home run. To contradict further human traders’ belief in a secret to trading the Market, A.I. believes that the Market is close to random. And adopting the law of large numbers is the key to success in the stock market.

Many investors and hedge funds are looking for an investment vehicle with low or no correlation with market behavior. In AlgoMerchant, we first introduce the first algorithm that uses long and short strategies to profit from the stock market. Sneak peek at the power of Viki and how it benefits traders and investors.

The overconfidence has led human to downplay the true power of the technology, Artificial Intelligence. Some are still sceptical whether A.I. can mimic the human’s brain to learn, analyze, feel, trade, or even adapt to the market. And interestingly, many retail investors are still unaware that today’s top hedge funds, like Renaissance Technologies or Two Sigma, use artificial intelligence models to help make trades.

That is why this course’ will tell you more about the different approaches between A.I. and humans. A.I. uses historical stock data to learn how the market reacted in the past and validate its performance. The intelligence makes no assumption about the market, and the execution is purely based on empirical evidence. No emotions or guessing works are involved. A.I. is an ‘evolutionary computation’ that learns both winners and losers and codes them into their genes to generate the next trades.

There are also incidences when A.I. terribly fails to trade the market. This happens because of wrong implementation for example, when the algorithms’ predictions based on historical data cannot be replicated using a new data set, and human overfit the rules. Or when the algorithm focuses on thinly traded equities, which is oversimplified and not realistic in an actual market situation. So, human should not train A.I. in a wrong way too! During the web class, we will learn more about humans’ limitations from being emotional to computing power, and many areas in which machines excel. The technology, Artificial Intelligence, scientifically improve our chances to make money in the stock market. Finally, you only have two options to choose. You can either reject or embrace A.I. as your partner in stock investing. Regardless of your decisions, we proudly present you ‘A.I. vs Human in Stock Investing’ that uncovers many facts about A.I. that people do not know. And how you can exploit them to your benefit.

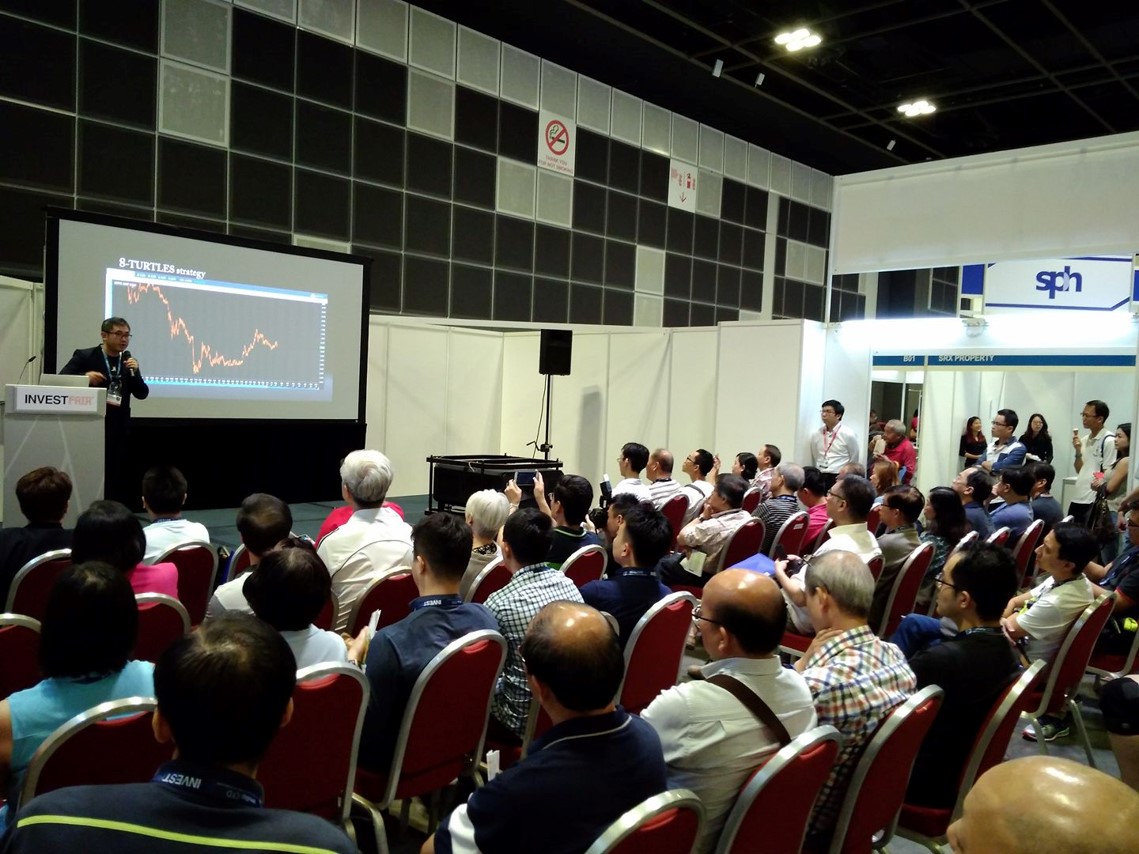

Rein Chua is a co-founder and Head of Training at AlgoMerchant, with over 15 years of experience in cross-asset trading, portfolio management and entrepreneurship. He has been featured by several major media like Business Times, Yahoo News, TechInAsia, etc., and invited as a panel speaker by various financial related institutions such as Singapore Stock Exchange, Indonesia Stock Exchange, Share Investors, etc., to give various insights on the how Artificial Intelligence and finance will shape the investment landscape.

Today Rein is managing prop trading fund and actively teaching retail investors and professional on systematic and quantitative trading approach. And he loves to share professional knowledge and experience on how to consistently profit from the stock market.

The information, tools and material presented in this Site are provided to you for informational purposes only and are not to be used or considered as an offer or invitation to sell or issue or any solicitation of any offer or invitation to buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The Site’s contents may not be reproduced in whole or in part or otherwise made available without the prior written consent of AlgoMerchant. Information presented in this Site have been obtained, derived or analyzed from sources believed by AlgoMerchant to be reliable, but AlgoMerchant makes no representation, warranty or guarantee as to their accuracy or completeness. To the extent permitted by applicable law, AlgoMerchant accepts no liability for any loss arising from the use of the material presented in this Site or software provisioned by this Site. No market data or other information is warranted or guaranteed by AlgoMerchant as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such market data and information are subject to change without notice. All of the information, including but not limited to our ‘Performance Simulation’ feature, will always strive to be unbiased in its reporting. AlgoMerchant, or its affiliates, may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Those communications reflect the assumptions, views, and analytical methods of the persons that prepared them.

With AlgoMerchant your account is secure. For your peace of mind, we use advanced firewalls and Secure Socket Layering (SSL) technology, automatic sign-out, and failed login limits to keep your personal information secure.